The industrial machinery sector has always been the backbone of the significant presence of Italian manufacturing in international markets and occupied a leading factor behind the other “Made in Italy” industries.

Machines have retained an emblematic place in the food and beverage industry. Over the last twenty years this industry has supported the Italian food and beverage sector and the export of its products all over the world.

Slicing machines, machines for processing bakery products, food and beverage vending machines, cocoa processing machines, equipment and tools for cereal production, machines and apparatus for the industrial preparation of fruits and vegetables, and wine presses are just some examples of products made by companies in this industry. Contrary to a shared belief, the high fragmentation of production is not an element of weakness, but rather, a strong point of this industry. In fact, Italy showcases many companies with several brands recognized by the market and leaders in their respective niches. Quality standards of excellence (not limited to technological), ability to develop customized solutions, high flexibility, and after-sales service have reaped excellent results for Italian companies both in Italy and abroad.

In Italy today, there are 2100 companies active in this industry, corresponding to a production value of 7 billion euros and over 26 thousand employees. Most of these companies are small and medium-sized, accounting for 70% of the total turnover. In line with the production specialization of the customer industry, the segments related to the cereal supply chain and to the processing of tomatoes and wine are the most relevant. A very high level of machine customization was made possible by the close collaboration between technology producers and food companies.

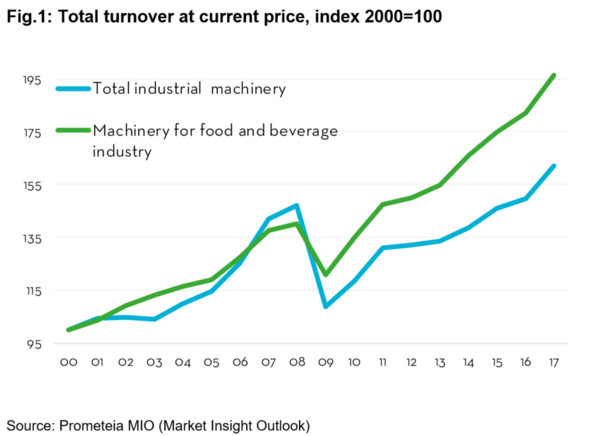

Judging from balance sheet data, this strategy has guaranteed a significant growth to companies in the sector over the last twenty years. Compared to the early years of this decade, the industry turnover has more than doubled, growing at a quicker pace than the average of the machinery sector as a whole (Figure 1). In addition to the growth in turnover, these companies showed a constant improvement in industrial profitability, with a ROI index that now stands at around 17%, a historical maximum level for manufacturers of food and beverages machinery and almost double compared to the reference benchmark.

These results are not only due to the collaboration with the Italian food and beverage industry, but also with exports in the last decade. Compared to 2007, the value of foreign sales grew by 48%, exceeding 3.5 billion euro (50% of industry turnover). A significant result also on a global scale, where Italy, with a 16.1% share, tops the list of the main world exporters. A first place obtained in 2014 overtaking Germany that in the last 15 years, lost about 4 percentage points of share, penalized by the arrival of China in the international arena. On the other hand, growing competition has not affected Italian positioning, thanks to the composite and highly specialized character of its productions and to a geographical framework much more diversified than its international competitors.

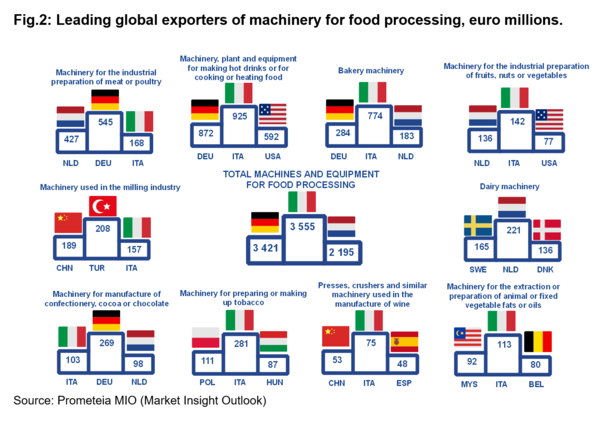

Looking at the individual types of machines, Italian exports are on the podium of the main world exporters in 9 categories out of 10 (6 first places, 1 second place, 2 third places). The most relevant positioning is in technologies for bakery products and tobacco processing machines (figure 2). It is in these two segments that the Italian producers have shown the most significant share gains for Italian producers compared to the first years of the last decade. On the other hand, producers of machines for wine processing have shown a significant drop in competitiveness, surprised by the exponential increase in Chinese exports in the NAFTA area and by the growing penetration of Spanish products in the nearby EU markets.