After the 2018 peak (we estimate an annual increase of 3.8% for world GDP, at constant prices), international economic growth is set to continue at a more moderate pace in 2019-‘20. Moreover, this picture is studded with a number of (downside) risks: great uncertainty on the future trend of world trade (because of the escalation in the US-China “trade war”), prospects of a Chinese "hard landing", increased risks of fragmentation of the Euro Area, and last but not least, tough negotiations for Brexit. Each one of these threats potentially foreshadow a number of alternative scenarios.

On this evidence, Italian manufacturing firms will have to deal with a complex situation in the next few years. Nevertheless, we forecast only a slight deceleration for industrial activity, not a decrease. In 2019-'20, the manufacturing turnover is expected to expand at an average annual rate of 1.6%, at constant prices. This growth will be supported by a greater strength of Italian firms, as a result of a deep transformation triggered by the crisis, and under the hypothesis that the above mentioned risks will be bound (for details, refer to “Analisi dei settori industriali”, Prometeia-Intesa Sanpaolo, October 2018).

Indeed, the achievement of these goals in such a challenging context discounts the fact that Italian firms will continue investing in innovation, combining both technological and organizational aspects, while enhancing the human capital. The ongoing digital transformation and the growing awareness of the importance of themes like sustainability and environmental protection will boost investment opportunities. Therefore, the propensity of Italian companies to invest, in the most innovative intangibles as well as in the material components, will remain high.

This confirms observations made during the last ten years when, despite a persisting gap between the main European competitors, investment in Italian intangible assets has performed better than total investment (+ 23% against -12% in 2008-'17, according to National Accounts data), giving a positive contribution to GDP growth.

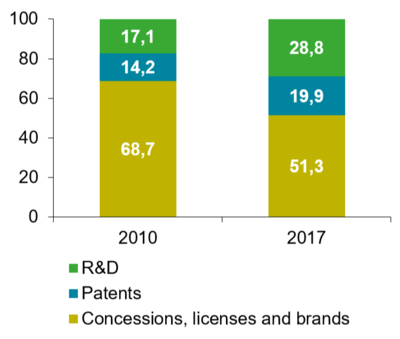

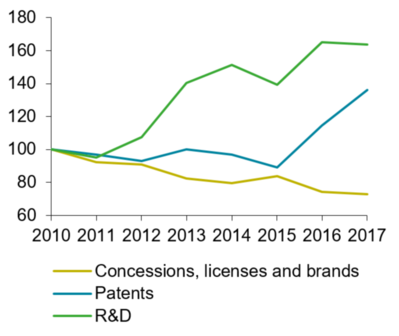

An analysis of the balance sheets of a large sample of manufacturing companies (about 22 thousand firms) over the period 2010-2017 confirms the importance of intangible assets, especially in regard to innovation and know-how (R&D, patents, protection of intellectual property, licenses, and brands), albeit with sector specific paths.

In 2017, the average weight of these components on net fixed assets was estimated at 6.5%. We find higher values for sectors with more differentiated products and where the technological component is more relevant as well as in sectors where investment in intangibles became necessary to remain competitive. For example, Home Appliances (14.2%, especially R&D and brands), Fashion (11.8%, concessions, licenses, and brands, but also patents, especially in the upstream stage of the supply chain), Pharmaceuticals (11.6%, above all patents), and Automotive (10.2%, with a rising R&D component, according to the increasing importance of technology in vehicles and investments aimed at the conversion towards hybrid and electric engines). Moreover, Machinery and Equipment (7.8% the weight of fixed assets in innovation and know-how on net fixed assets in 2017), Electrical Equipment (9.6%), and Computer and Electronics (8.9%) can also be mentioned as sectors that have strengthened investment in intangible assets in the recent years.

On the other hand, intangible assets play a less significant role in the intermediate goods sectors (Intermediate chemicals, Basic metals, Metal products, Construction materials), due to more a standardized production process.

The share of resources invested in intangible assets has a positive relationship with the firm's class size. In general, large companies show a much more sustained growth for R&D assets and patents.

In the coming years, a positive attitude towards investments in intangible assets will be crucial, not only for large firms, but also for small and medium enterprises.