The Italian construction sector has started a path of recovery. Investment is set to grow at a rate of 1.9% in 2018, driven by residential construction (+2.6%), which can be attributed to a persistent growth in building renovation activities thanks to fiscal incentives, and by the first signs of recovery for the new construction segment.

Also, non-residential construction is contributing to the sector recovery, boosted by investment in equipment. On the other hand, civil engineering is confirming a weak trend, due to the further fall in PA investment (estimated at -2.2% in 2018), which is reflected in a substantial stalemate in the implementation of infrastructural projects.

Forecasts for the next two years show a strengthening of the construction recovery, expected to spread to all segments. Civil engineering is projected to become the most dynamic sector, assuming the hypothesis of a rebound of public investment, contributing in 2020 to a 2.5% growth of construction. Estimates are based on the resources allocated in the 2017-2018 Budget laws and on additional resources allocated by the new government with the aim of reversing the decrease of the share of public investment on GDP.

Also a recovery of capital expenditure from Local Administrations is expected, overcoming the difficulties – primarily the lack of project skills – which so far have prevented the progress of infrastructural works. Forecasts are also based on most recent data on public tenders, signaling a positive trend once the negative effects related to the new Public Procurement code have been overcome.

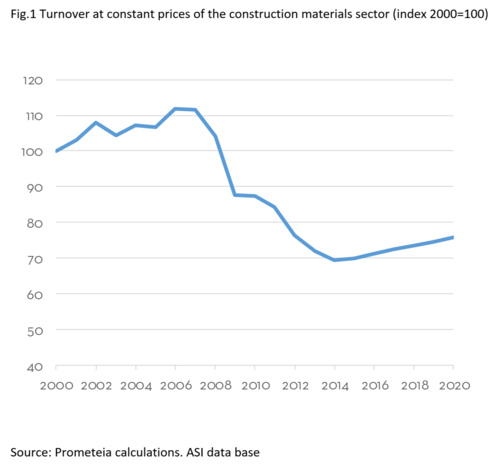

Based on this scenario, in 2019-’20 the construction materials sector is set to record a more sustained growth (CAGR 1.6%), although not sufficient to return to pre-crisis activity levels: again in 2020 the turnover level is predicted be less than in 2007 by over 30%. The domestic market will continue to contribute significantly to growth of glass and basic materials (especially cement, concrete, bricks…) thanks to the demand triggered by civil engineering. The dynamics of sales on foreign markets are also expected to be positive (CAGR 1.7%).